2/24/2025

GIFT CARDS ARE FOR GIFTS - NOT PAYMENTS!

If someone asks you to pay with a gift card - it's a scam! Gift cards have become one of the most popular payment methods for scammers as they’re easy to buy and share, hard to trace, and nearly impossible to refund once their balance has been spent. They're like cash.

Here’s how to tell if you’re dealing with a gift card scam:

You’re asked to pay by gift card for services that should accept other forms of payment. If someone claims to be from the IRS, your bank or utility company, or a similar institution and asks for gift cards, they’re scamming you. These companies and agencies will not ask you to pay with gift cards.

You’re told to use gift cards to move funds or “protect” your bank balance. Transfers and balance protection are natively built into banking platforms and never require gift cards to move funds or complete a wire transfer.

The person requesting that you buy gift cards creates a sense of urgency. Fraudsters may request gift cards to stop one of your accounts from being closed or even to “prevent” fraud on one of your debit cards. This is a lie.

They may guide you through the gift card purchase process with very precise instructions and tell you to lie or keep it a secret if asked about the purchase.

You’re told to stay on the phone while you buy gift cards. Established organizations won’t ask you to buy gift cards, and they certainly won’t keep you on the phone while you’re doing it. Scammers adopt this strategy to ensure victims follow through with their demands.

They will ask you for the gift card number and the pin. Giving this information allows the scammers to get the money you loaded onto the card - even if you still have the card in hand. Don't ever give out this information OR send a photo of the front and back of the card. Anyone who has that info also has access to the funds loaded on the card.

The bottom line: Gift Cards should only be used as gifts — not as payment for services, fines, or goods. If anyone pressures you to buy or send them gift cards, it’s a scam. If you've been scammed, you can report it at

http://www.reportfraud.ftc.gov/

2/21/2025

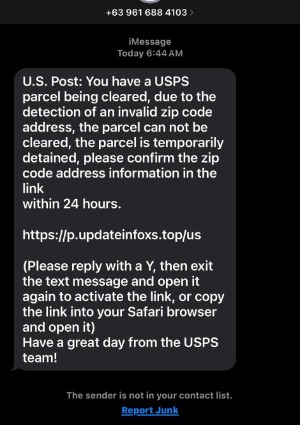

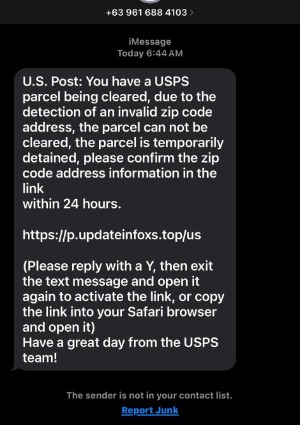

THIS IS AN ACTUAL TEXT MESSAGE THAT IS CIRCULATING. IT IS A SCAM!

When you receive an unknown text, stop and think before you click on a link. Sometimes a scam is easy to spot and sometimes they look legit. These messages are designed to trick you into sending confidential information or money. We will never text, email or call you asking for personal account information.

Here's how to spot a text scammer

Unknown Number - In most cases, a text from an unknown number should raise red flags. Before you take action - check out the number your bank would normally use to contact you. Even your phone is spotting the scammer and alerts you that the sender is not in your contact list.

Abbreviated Name - Sometimes scammers abbreviate company names or even get them outright wrong. It’s one more thing to watch for as you try to keep your money and info safe. This message didn't come from us OR our friends a Wyoming Bank & Trust. It is a scam!

Uses Scare Tactics - Scammers create a false sense of urgency to trip you up. And, they can be convincing. “Your account has been put on hold due to unusual activities” can sound pretty scary when you are led to believe your money is at risk. You do not ever have to act quickly. Always take a minute to stop and evaluate the text.

Prompts You to Open a Link - We cannot remind you enough of the risks of clicking links from texts. A scammer’s main goal is to get access to your money or sensitive information. Links are a key tool they use. They hope to capture your log in or other info in a couple of ways. Banks rarely, if ever send links via text.

We are committed to helping you spot scams, because when you know something sounds suspicious, you can stop criminals in their tracks. Be scam smart! Think before you click any link and PLEASE don't ever give out your banking or personal information.

2/19/2025

Don't get tricked by the Meta Scam!

Meta warning scams are phishing attempts that use fake messages to trick users into clicking on links or sharing sensitive information. The messages may claim that a user's account is at risk or that their page violates Meta's policies. Check out the message we recieved in our business page in-box and see if you can spot the scam.

Here's how it works

Sneaky scammers use official logos and branding to make their messages appear legitimate. (But if you look at the name the message came from, it is clearly a scam).

They use fear-based tactics, such as threats of account suspension or deletion. (Fear of losing an account makes the victims react. Don't be quick to click.)

They include a link that leads to a fake log-in page and prompts you to input personal information, such as login credentials, password, or financial information.

Tips to Avoid Getting Scammed

1. Use some common sense. Slow down and take a closer look at all the clues that give it away that something just isn't right - before you click.

2. Be cautious of messages that use urgent language or that use threats.

3. Don't respond to messages that ask for your login, password, social security number or credit card information.

4. DO NOT GIVE OUT YOUR PERSONAL INFORMATION. Once you give your login credentials to anyone else, they have now taken over your account and it may not be retrievable. If you do give out you personal or banking information, don't delay. Call your bank immediately to get help with your accounts.

12/4/2024

SPOT THE SCAM -

During the holidays, more and more messages like these are sent out by scammers in an attempt to steal your personal or banking info. Don’t get tricked to click.

Have you ever received unsolicited text messages with an unfamiliar or strange web link that indicates a USPS delivery requires a response from you like the one seen below? If you haven’t signed up for a USPS tracking request for a specific package, then don’t click the link! This type of text message is a scam called smishing.

Smishing is a form of phishing that involves a text message or phone number. Victims will typically receive a deceptive text message that is intended to lure the recipient into providing their personal or financial information. These scammers often attempt to disguise themselves as a bank, USPS, government agency, other company to lend legitimacy to their claims.

The criminals are attempting to gather your personally identifiable information (PII) such as: account usernames and passwords, Social Security number, date of birth, credit and debit card numbers, personal identification numbers (PINs), or other sensitive information. This information is used to carry out other crimes, such as financial fraud.

If you suspect the text message you have received is suspicious but are expecting a parcel, please do not click on any links

If you do get tricked and give out your information, please call your bank immediately.

11/26/2024

'TIS THE SEASON - TO WATCH OUT FOR SCAMMERS

Here are a few holiday tips to safeguard you from potential scams and malicious intent.

Beware of bogus links. Don't be so quick to click. Think before you click on links and advertisements for holiday deals, notifications about package delivery problems, or warnings of compromised accounts. These could be from scammers who are hoping you will divulge personal or financial information.

Watch out for fake order confirmations. Scammers may impersonate well-known retailers (like Amazon, Walmart, Target or Costco) by sending a text or email confirming a recent purchase you supposedly made totaling several thousand dollars. The message usually contains a link or phone number to call to cancel the order and receive a refund. But, if you follow the instructions, you will end up giving account credentials (and access to your money) to a scammer. You can safely verify the status of your account at any time by going to the verified website address of the retailer in question, where you can then view your orders, track shipments and securely contact customer service.

Beware of package delivery scams. Scammers send texts and emails that look like they come from the U.S. Postal Service, UPS, or FedEx saying things like - you missed a delivery or there’s an update about your package. These sneaky scammers are trying to steal your money or sensitive data by prompting you to provide personal or payment information. Do not interact with the message.

It can be tricky trying to figure out what is legitimate and what isn't. If something doesn't feel or sound right, it probably isn't. If you accidentally give out your banking information - call your bank immediately. We are here to help!

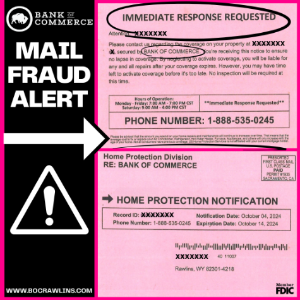

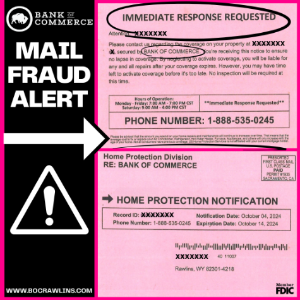

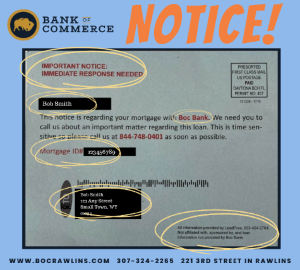

10-16-2024 MAIL FRAUD ALERT

CUSTOMER NOTICE - MAIL FRAUDIt has come to our attention that US Home Protection Services sent a mass mailing to some of our customers "regarding the coverage on your property secured by BANK OF COMMERCE." The image below is a copy of the postcard some of you may have received. Here's a couple things you need to know.

CUSTOMER NOTICE - MAIL FRAUDIt has come to our attention that US Home Protection Services sent a mass mailing to some of our customers "regarding the coverage on your property secured by BANK OF COMMERCE." The image below is a copy of the postcard some of you may have received. Here's a couple things you need to know.

- We did not share your personal or banking information with US Home Protection Services. Companies like these purchase mailing lists that include publicly recorded documents such as deeds, mortgages, and releases that are placed on permanent record using the state or county's database.

- We won't request time sensitive information using a post card mailing. If we need information, our friendly staff (who are familiar to you) will contact you directly. You will be able to verify who we are and that the info we are requesting is legit.

- You will see identifiers like our logo with our local mailing address, local phone number and website on all mail coming from Bank of Commerce.

Before you panic and call the number listed on correspondence like these, take a look and notice things like those circled in the image seen here.

- The sender made this seem urgent using BOLD ink and bold letters at the top of the listing prompting an IMMEDIATE RESPONSE.

- They addressed you by name on the postcard making it feel personal (which could lead you to trust them and the information you are reading).

- They listed something familiar to you by using our name Bank of Commerce and mentioned your loan.

- In the tiniest font they could get away with, the sender included a disclaimer on the bottom that is difficult to notice - informing you that they are US Home Protection Services and NOT your actual bank.

This company is likely trying to sell you something you don't need or already have OR they are just using this tactic to gain your personal and banking information. That's a scam! So, what should you do? Tear it up and throw it away. Definitely don't give them any personal or banking information. If you are unsure, you can also give us a call and we would be happy to verify the legitimacy of the mail you received at 307-324-BANK.

We urge you to THINK BEFORE YOU REACT. Scammers are sneaky and we will do our best to keep you informed. THANK YOU to those who have called or stopped by with the cards asking about the legitimacy. You are SCAM SMART! Share this information with your family and friends.

9-9-2024

THIS IS AN ACTUAL TEXT MESSAGE THAT IS CIRCULATING. IT IS A SCAM!

THIS IS AN ACTUAL TEXT MESSAGE THAT IS CIRCULATING. IT IS A SCAM! Don't get tricked by the Meta Scam!

Don't get tricked by the Meta Scam!

CUSTOMER NOTICE - MAIL FRAUD

CUSTOMER NOTICE - MAIL FRAUD.png)

1. Read it. (DON'T PANIC CLICK) Then read it again, looking closely for indicators that it is a scam.

1. Read it. (DON'T PANIC CLICK) Then read it again, looking closely for indicators that it is a scam. Sneaky Scammers are always working to find new, creative ways to get your personal information. Because your safety and peace of mind matter, we would like to remind you that if you get a phone call that appears to be from Bank of Commerce but they are requesting your personal information, it is NOT US. Do not give your information out. Hang up and give us a call if you are ever in doubt.

Sneaky Scammers are always working to find new, creative ways to get your personal information. Because your safety and peace of mind matter, we would like to remind you that if you get a phone call that appears to be from Bank of Commerce but they are requesting your personal information, it is NOT US. Do not give your information out. Hang up and give us a call if you are ever in doubt. Account takeover fraud is where scammers gain access to your online accounts and do things like withdraw large sums of money from your accounts or change your personal information so you cannot log in. BUT. . .how did they get that information? Many times they use their sneaky or scare tactics to trick YOU into giving out your account information. Don't ever give out your banking login and password. That allows direct access to your hard-earned money. Here's a few tips for safeguarding your accounts:

Account takeover fraud is where scammers gain access to your online accounts and do things like withdraw large sums of money from your accounts or change your personal information so you cannot log in. BUT. . .how did they get that information? Many times they use their sneaky or scare tactics to trick YOU into giving out your account information. Don't ever give out your banking login and password. That allows direct access to your hard-earned money. Here's a few tips for safeguarding your accounts: IF YOU GOT THIS TEXT OR ONE THAT LOOKS LIKE IT - DON'T CLICK THE LINK. IT IS NOT US!

IF YOU GOT THIS TEXT OR ONE THAT LOOKS LIKE IT - DON'T CLICK THE LINK. IT IS NOT US! This is an actual text message several of our customers have received. At first glance this text makes you think your bank card has been compromised and is locked out, right?! WRONG! This is known as SMISHING and is one of the most common tactics used to steal customer information. It immediately tricks us using a fear tactic. When you receive a message from an unknown sender DON'T BE QUICK TO CLICK.

This is an actual text message several of our customers have received. At first glance this text makes you think your bank card has been compromised and is locked out, right?! WRONG! This is known as SMISHING and is one of the most common tactics used to steal customer information. It immediately tricks us using a fear tactic. When you receive a message from an unknown sender DON'T BE QUICK TO CLICK. What is the Scholarship / Financial Aid Scam

What is the Scholarship / Financial Aid Scam t has come to our attention that LeadPros sent a mass mailing to some of our customers regarding "your mortgage". The image below is a copy of the postcard some of you may have received. Here's a couple things you need to know.

t has come to our attention that LeadPros sent a mass mailing to some of our customers regarding "your mortgage". The image below is a copy of the postcard some of you may have received. Here's a couple things you need to know.